ZealID

KYC app EU banking

Project name: ZealID

Start date: March, 2021

Introduction

This case study focuses on the challenges faced while conducting Usability testing for the ZealID KYC iOS app within the Finnish banking system.

The objective was to identify usability issues and propose improvements to enhance the user experience.

The study also involves understanding the integration of ZealID with the third-party provider, IDNOW.

The process involved using personas, defining and analyzing the user journey, conducting red routing analysis, and providing detailed descriptions of the main bugs and usability issues.

The findings were reported through a usability testing video, accompanied by screenshots showcasing the issues before the redesign and the improvements made.

Our challenge

The challenge was to conduct Usability testing for the ZealID, iOS app within the Finnish banking system. KYC (Know Your Customer) processes are essential in the banking sector to verify the identity of customers.

ZealID aimed to streamline this process by providing a user-friendly mobile app for customers to submit their identification documents securely.

The challenge was to ensure that the app’s user interface was intuitive and easy to navigate, adhering to the expectations of Finnish banking customers.

Our approach

- Personas: To understand the target audience, personas were created representing typical Finnish banking customers. These personas encompassed different demographics, such as age, occupation, and digital literacy, to capture a broad user base.

- Define and Analyze: The user journey within the ZealID KYC app was defined and analyzed. This involved identifying key touchpoints and interactions the user would have during the KYC process, such as scanning identification documents, inputting personal details, and submitting the information.

- Red Routing Analysis: The red routing analysis aimed to identify critical usability issues that hindered users from completing the KYC process successfully. This involved testing the app with real users while monitoring their interactions, noting any difficulties or frustrations they encountered.

Reporting Findings

The findings were reported through a red routing analysis and detailed descriptions of the main bugs and usability issues. The analysis revealed several key areas for improvement, including:

- Navigation: Users found it challenging to locate specific features within the app, such as the document scanning functionality and progress indicators during the KYC process. This led to confusion and a sense of disorientation.

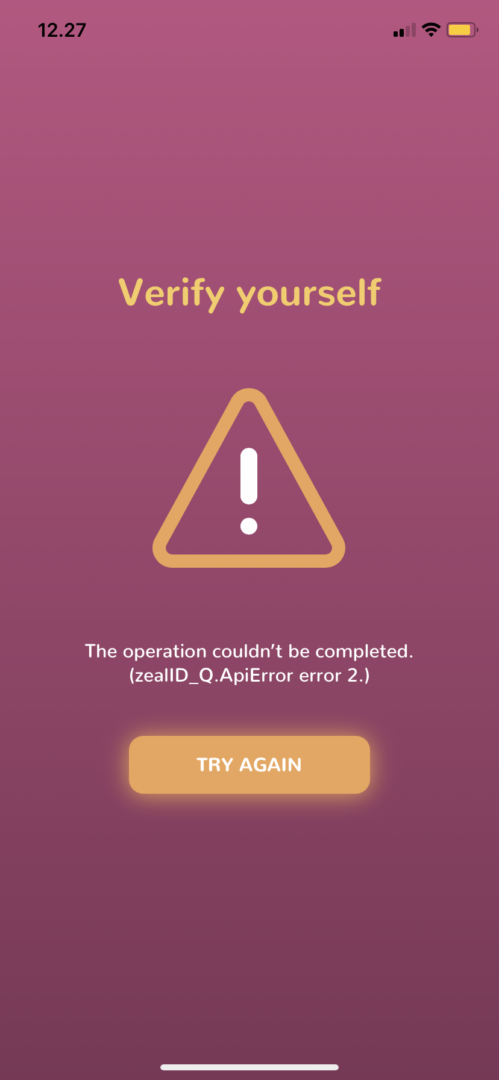

- Error Handling: The app did not provide clear error messages or suggestions for correcting mistakes. Users struggled to understand why their submissions were rejected and how to rectify the issues.

- Visual Clutter: The app’s interface appeared cluttered, with excessive text and visual elements that overwhelmed users. This resulted in information overload and hindered the overall user experience.

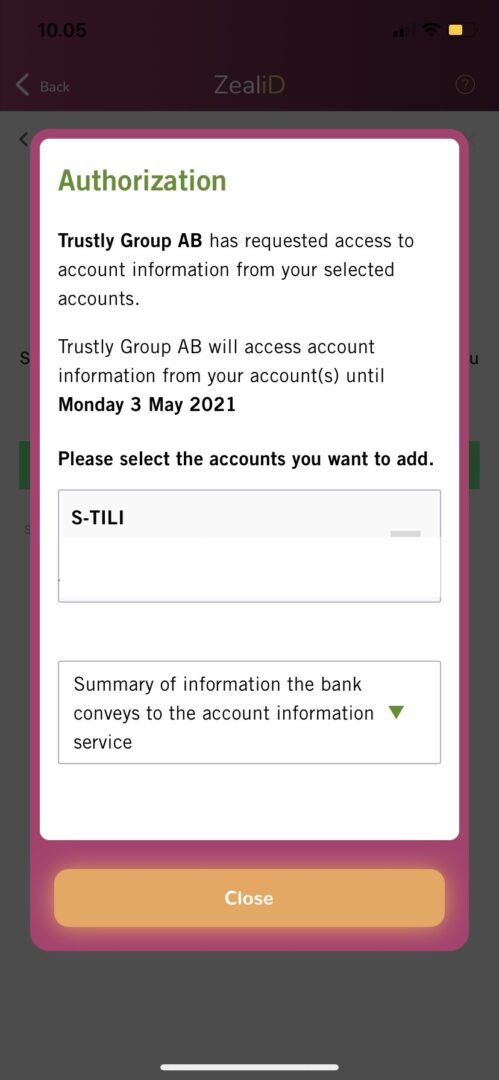

- Integration with IDNOW: Understanding the integration of ZealID with the third-party provider, IDNOW, was crucial. IDNOW provided backend services for identity verification. It was essential to ensure a seamless integration to maintain a smooth user experience.

Findings

Usability Testing Video: To provide a comprehensive understanding of the recurring issues, a usability testing video was created. The video showcased users interacting with the app and encountering the identified usability issues. It served as a valuable visual resource for stakeholders to observe user struggles and empathize with their experiences.

Understanding IDNOW Integration: The ZealID app integrated with IDNOW as a third-party provider for identity verification. IDNOW offered robust identity verification services through secure backend processes. ZealID utilized IDNOW’s APIs to facilitate the seamless transmission of user data and identification documents, ensuring compliance with legal and regulatory requirements.

Bugs Before Redesign: A screenshot shows the API error thrown when reaching the verification step. Other than that, users struggled to find the document scanning feature, leading to frustration and prolonged KYC completion time.

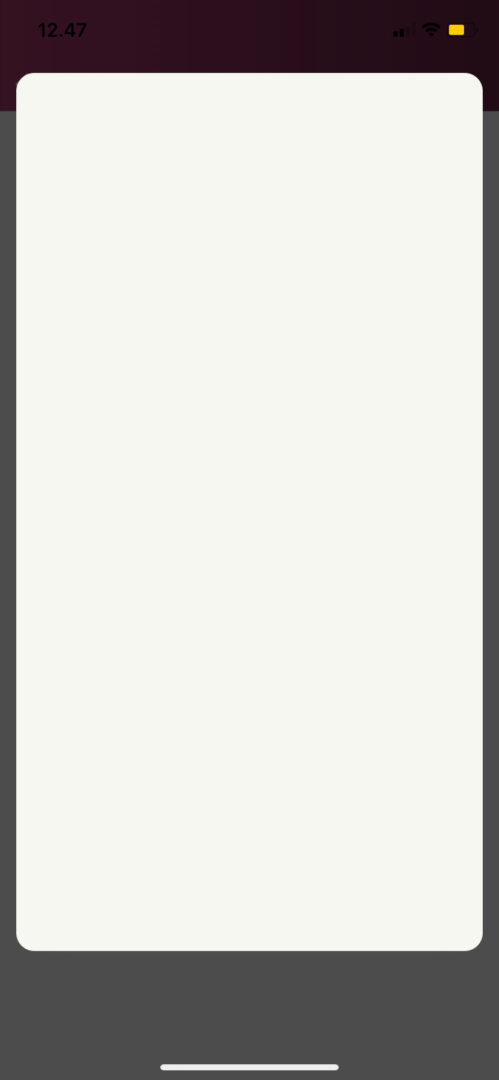

Another screenshot highlights the blank modal displayed after the bank account authorization. When users encountered this kind of bug in their submission, the app did not provide specific guidance on how to rectify the problem. This left users uncertain about the necessary steps to correct their submissions and led to incomplete verification.

A screenshot demonstrates the visual clutter in the app’s interface. Excessive text, unnecessary graphics, and overlapping elements made it difficult for users to focus on the essential information. This resulted in a visually overwhelming experience and hindered user engagement.

Improvements After Redesign:

After the redesign, a simplified and intuitive navigation structure including clear notifications about the other steps has been introduced. The document scanning feature is prominently displayed on the main screen, making it easily accessible to users. Clear visual cues guide users through the KYC process, ensuring a smoother and more efficient experience.

The error-handling issue was addressed in the redesigned version.

The app only shows a user-friendly error message with specific instructions on how to rectify the submission errors.

The app provides clear guidance, enabling users to understand and resolve issues quickly and effectively.

The redesigned interface focuses on visual clarity and decluttering.

The app features a cleaner and more organized layout, with simplified text and streamlined graphics. This enhances readability and enables users to concentrate on essential information, reducing cognitive load and improving overall usability

Conclusion & Results

UX testing for the ZealID KYC iOS app within the Finnish banking system posed several challenges.

By creating personas, defining the user journey, conducting red routing analysis, and reporting findings, significant improvements were identified and implemented.

The usability testing video provided valuable insights into recurring issues, while screenshots illustrated the bugs before the redesign and improvements made afterward.

Understanding the integration with IDNOW ensured a seamless user experience during the KYC process.

Through comprehensive UX testing and redesign, the ZealID KYC iOS app was enhanced to meet the expectations of Finnish banking customers, providing a user-friendly and efficient platform for identity verification.